This post was last updated on August 11th, 2022 at 11:03 am

One myth about frugality is that it requires lowering standards, particularly with your food choices. But being frugal doesn’t mean having to eat mac & cheese every night. Whether you’re able to save in small ways or large, your evening routine is full of opportunities to fight inflation. All it takes is a little planning and an awareness of how your decisions are likely to impact both your pocketbook and health.

In a previous post, I dissected my morning routine to help readers see how cutting small expenses can lead to big savings over time. With the evening routine, your greatest opportunity to save is, not surprisingly, at dinnertime. Before you do anything else, figure out how much you’re eating out or taking delivery and how much you can cut back on both. Eating restaurant food can be a huge drain on the wallet because food costs account for only a small percentage of the restaurant bill, about 30%. When you eat out, you’re paying for so much more than food, including licenses, leases, taxes, and labor.

Does this mean I think you should never eat out? No. My family enjoys eating out to mark special occasions. In this way, we prevent eating out from becoming routine. When the motivation becomes convenience instead of celebration, that’s when restaurant outings can damage family finances.

Here’s another important reason why I prefer homemade meals: It puts me in control of what our family eats. The thing about restaurant food is this: You don’t always know what’s in it. Sodium levels, in particular, can be quite high in restaurant food compared to home cooking. Also, some dishes contain synthetic ingredients designed to preserve “freshness” or replicate the taste and texture of certain foods.

Fight inflation by letting your freezer create the menu

An important lesson I’ve learned about saving money at meal time is to let your freezer and pantry dictate what’s for dinner, not personal whims or special recipes. I do use recipes but mostly as a mealtime framework. I often substitute ingredients based on what I have on hand because I shop based on what’s best priced. That doesn’t mean I buy whatever is on sale, just certain dinnertime staples. This strategy can significantly cut grocery bills depending on how aggressively you shop discounts.

This strategy also requires ample storage space because a long time can pass between discounts. The price of your favorite cut of meat might drop only a few times a year, but you won’t have to pay full price if you carry a large supply of that meat in your freezer. For example, when my favorite grocery store dramatically discounted pork sirloin roast recently, I picked up 20 pounds worth. It will last us several months. By picking up large quantities at a discount, we’re able to blunt inflation’s effects on our finances.

I will note that if you maintain a second pantry and second freezer, it’s critical to consistently rotate items so that frozen and stored foods stay as fresh as possible. Otherwise, you run the risk of having to toss out food, completely undermining your shopping strategy! I’ve done it, and it’s frustrating.

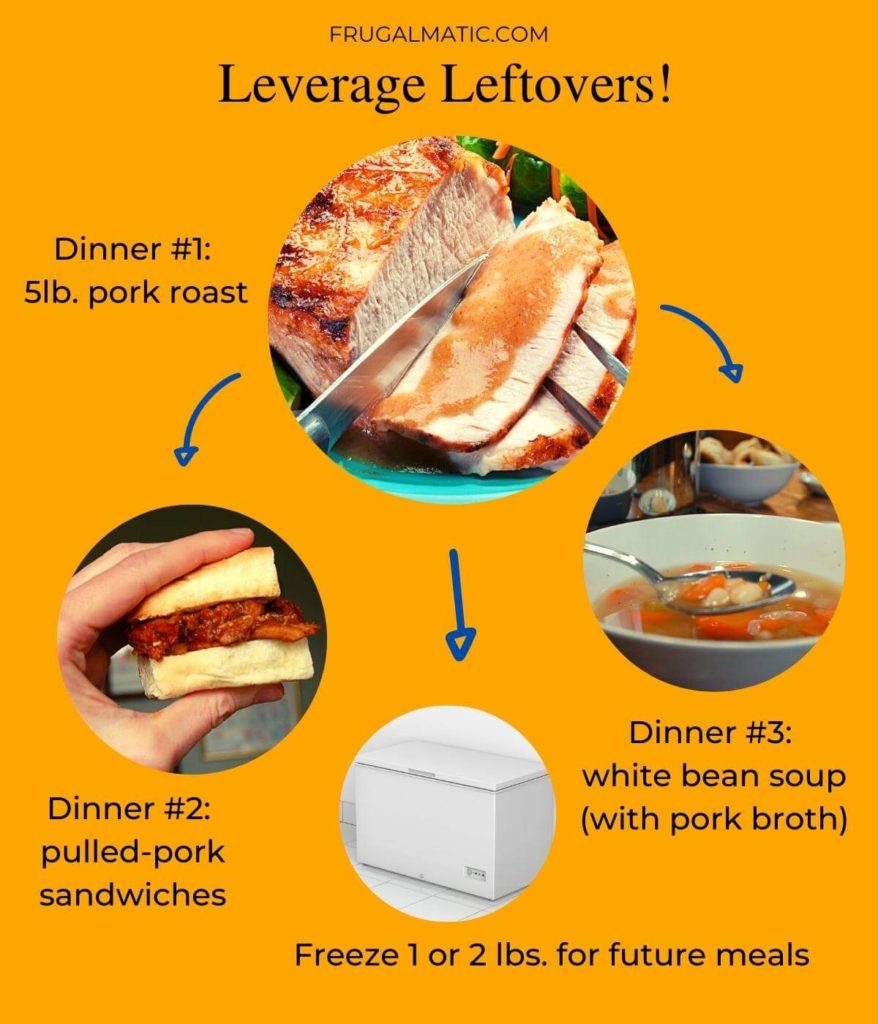

Leverage those leftovers

Aggressively shopping discounts helps create a cost-conscious dinnertime routine. The other important step is to leverage your leftovers. By stretching your dishes to feed your family over multiple days (and freezing extras), you’ll further reduce costs.

One of the beauties of buying whole foods is that, unlike processed foods, you gain a lot of freedom in how you cook. One stigma associated with leftovers is that it means eating the same thing night after night. When you start from a whole food, you can turn it into any number of dishes.

Dinner 01: pork roast

Let’s use my recent pork purchase for an example. During the first dinner, I served a pork roast. It was a basic meal with sides of potatoes and a veggie.

Dinner 02: pulled-pork sandwiches

The next dinner proved to be more exciting. I turned the roast into pulled-pork sandwiches using my homemade barbecue sauce. These sandwiches offered a completely different flavor and texture than the pot roast, and there was enough to eat for lunch the next day, too. Meanwhile, I set aside and froze some extra pork for future use.

Dinner 03: white bean soup using pork stock

For the third night, I made pork stock. I cooked the pork bones overnight in a slow cooker and then used that broth for a white bean soup. A 32-ounce bag of dried beans cost about $2, and I spent less than $5 on other additions, including carrots, celery, onions, and some spices. Plus, we had leftover soup for lunches. Over a total of five meals, the cost to feed the family was less than $20. You’d spend a lot more than that eating those meals at a restaurant.

Your meal options go far beyond pork, of course. You can leverage your leftovers with chicken, turkey, and beef—any meat will do. Use everything to maximize your savings, including the carcass for stock. If you don’t have enough bones, consider collecting them in a Ziploc bag and freezing them until you have the desired amount to make a stock.

Tap the power of post-dinner walks

A misunderstood aspect of frugality is that it’s all about money. In truth, wisely spending your time is just as important, especially to benefit your health. How you spend those post-dinner hours can affect your health, as Dr. James Levine noted in my interview with him. Blood glucose levels spike after each meal, and changes in your levels are a predictor of type 2 diabetes, he said. That’s why it’s important to be physically active after a meal. This isn’t training for a marathon. As Levine noted in his interview, a mere 15-minute walk after a meal can lower those blood glucose levels, turning them into a “hill” instead of a “big mountain.”

Living a healthy lifestyle can be a money saver because if you develop a chronic condition, you can spend a lot of money over a lifetime to manage that condition. But if you can prevent it, or minimize its negative effects, you will save money. At its core, being frugalmatic is about obtaining multiple benefits, especially indirect benefits, through your everyday activities. I doubt most people go on walks with the intention of saving money, but saving money can be the indirect result of leading an active lifestyle. It can reduce your long-term spending on doctor visits and drug prescriptions.

Personally, I don’t always go on walks after meals, but I make a point of doing something active: playing with our kids, working in the yard, shooting baskets in the driveway, prepping dinner for the next day, cleaning dishes, tinkering in the workshop, and on and on. The point is to avoid transitioning from the kitchen table to the living room sofa, typically to watch TV or scroll on the smartphone.

Read: How to stay active? Go on a ‘random walk’

Fight inflation through digital minimalism

Watching TV or scrolling on a smartphone is fine in small amounts, but digital devices can be addictive. It’s easy to spend too much time on them at the expense of our health. My strategy for limiting media consumption in the evening is simple: I restrict my access to screens. Regular readers of this website know I use a dumb phone instead of a smartphone. This has been a powerful tool for minimizing my digital media consumption.

One of my weaknesses is TV sports programming, but I limit the time I spend watching my favorite teams by not subscribing to cable, streaming, or satellite services. We use a rooftop antenna, which offers a small taste but not a large dose of sports coverage. Here’s how I get my “fix”: I listen to a lot of games over the radio. Radio is great because it’s free, and I can follow the games while getting stuff done around the house. Super frugalmatic!

Everybody has a different weakness when it comes to TV and digital media consumption. What’s yours? Once you identify it, consider creating barriers between yourself and that weakness. A firm barrier can reduce temptation. In my case, I’m not on the sofa watching baseball, football, and basketball games on TV because I can’t. I purposely cut myself off.

Better manage bedtime

In my experience, another benefit of limiting post-dinner screen time is it allows me to go to bed sooner than I otherwise might. It’s amazing how digital media can send us down rabbit holes that turn spending 5 minutes online into an hour. You maybe meant to go to bed by 10 p.m., but suddenly it’s 11. Ugh! We’ve all fallen down these rabbit holes, and the result can be lost sleep.

A poor night’s sleep can make it more difficult to take the necessary steps to fight inflation, such as preparing a meal. When we’re “too tired” to cook, the default option often becomes eating out. Getting a good night’s sleep can help you resist the siren call of convenience.

To fight inflation, become ‘wiser’ not ‘cheaper’

The choices we make in how we spend our time and money are interconnected. Frugality isn’t about being “cheaper.” It’s about making wise decisions. After all, how we spend our time affects our health, which ultimately affects our pocketbooks.

While it is impossible to completely insulate yourself from the effects of inflation, you can blunt its effects. With adjustments to your daily routine like the ones discussed in this post, you can save money over the long term. To maximize your savings, seek to make decisions that can also benefit your health. Saving money in a way that harms your health can defeat the whole point of trying to save in the first place.