This post was last updated on October 19th, 2020 at 03:59 pm

There’s one type of debt I’m happy to accumulate, and it’s not cheap. I’m paying 10% interest.

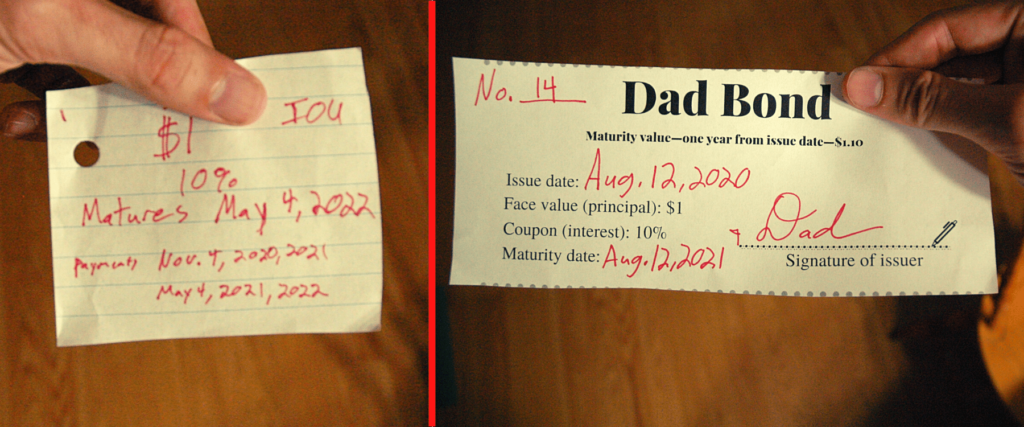

It’s all going to my kids in the form of an allowance. They’re called Dad Bonds.

I’m using the bonds to teach my kids about debt and how it works. The bonds make clear that debt involves a lender and borrower, and my hope is for my kids to aspire to be the former.

Talking to children about debt is more important than ever, in part, because there’s so little cash being used nowadays. My kids, when they accompany me to a store, rarely see cash being exchanged. Instead, they often see a credit card being swiped. When buying something online, I get whatever I want with few clicks of a mouse. A few days later, stuff magically appears at the doorstep. There’s no longer an easy way for a child to grasp how money or debt works.

Enter Dad Bonds

The bond thing started one day as a result of me being short on cash after our kids did some extra work around the house. They can earn $1 for doing a random job, such as picking up sticks in the yard, weeding gardens, sweeping out the garage or helping me wash our vehicles.

I’ve given the kids IOUs before, but it suddenly dawned on me that IOUs weren’t fair. IOUs amount to little more than vague promises to pay someone at some future point at 0% interest. So I had another idea: What better way to teach my kids about debt than for me to issue them a bond?

You don’t have to be a financial professional or have an in-depth understanding of finances to show your kids the basics of a bond. It’s a matter of explaining how principal and interest work together. The principal is $1, I explained to the kids. The bonds “mature” in two years. If you hold the bond until maturity, I explained, you will receive that $1 in principal—plus $0.20 in interest, I said. (At the time, I pledged to make interest payments every six months, but I later decided to shorten the bond term to one year and only make an interest payment when the bond matures.)

I’m not saying they grasp the entire concept, but it got the wheels turning. Since creating the first Dad Bond, I’ve given the kids two options to take $1 payments: You can either have the $1 now, or you can receive $1.10 in one year. Sometimes they want the cash, but I’m surprised how often they want a Dad Bond. I’ve now issued 17 Dad Bonds and have been documenting them in a notebook.

(The kids do have the option of selling the bonds back to me to “raise cash,” though I advise them they won’t reap the benefits of future interest payments if they sell the bonds before maturity.)

All in the name of education

I’m racking up debt—all in the name of education. I occasionally quiz my kids on how these bonds work and, for this blog post, asked our 5-year-old said, “What does it mean to hold a Dad Bond?”

His response: “To collect interest over time.”

Not bad. Not bad at all.

The whole point of the Dad Bond is to get my kids thinking about debt. It has enabled deeper conversations at the dinner table and at the swing set about types of debt, from mortgages to credit cards. When our kids see me use a credit card, they know it’s a form of debt, not unlike the Dad Bond. They also learn our family pays off credit card debt right away to avoid paying any interest on it. Above all, I don’t want the kids to think it’s acceptable to owe interest on credit card debt.

However, it is OK for others to owe you interest, and the kids know what it means to owe somebody money because I owe them money through the Dad Bonds.

How do you make debt ‘real’ to kids?

There are many online programs and games available for teaching kids about money, and many of them promote activities to make money “real” to children. The Dad Bond is one way to teach kids how debt works. My goal is mainly to create awareness of debt, encouraging kids to collect interest payments instead of having to owe interest.

It’s strictly a teaching tool and certainly not investment advice. Investment-grade bonds pay absurdly low interest rates nowadays (thanks to the Federal Reserve’s aggressive intervention in markets–but that’s a topic for another blog site!), and so I’m not a big fan.

If you haven’t begun talking to your kids about how debt works, the Dad Bond is a good conversation starter. If you do it, I’ve found it helpful to discuss the purpose of the Dad Bond every time you issue one.

I also try to make clear to my kids they have a choice: They can either accept a cash payment now or receive a Dad Bond that will allow their cash to grow from $1 to $1.10 in one year. Ten cents might not sound like much, but each of my kids has amassed about 10 bonds each, and so that means the interest will create another dollar for them over a year. Despite the effects of inflation, a dollar today is not an inconsequential amount of money for a lot of kids.

Every parent has tips and tricks for teaching kids about money. What are yours? Do you have different strategies for teaching financial concepts to your kids? Let Frugalmatic readers know in the comments below.