This post was last updated on April 11th, 2022 at 09:46 am

Dave Ramsey has built a small media empire around the idea of living debt free. “Debt is dumb,” he says. And he’s right. He advocates for using what he calls the snowball method. Pay off your smallest debts first and work your way toward the largest.

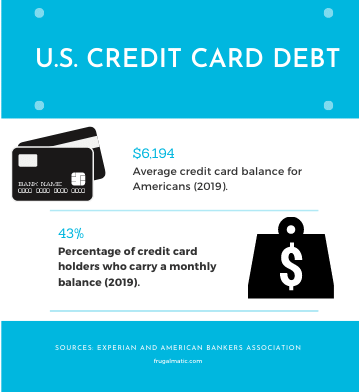

Credit card debt is often people’s smallest debt and typically the most expensive, charging double-digit interest rates. It’s also people’s “dumbest” debt because most things we buy with credit cards quickly depreciate in value, i.e. clothes, gadgets and appliances.

I like Ramsey’s attitude toward debt. The only thing better than paying off your credit card debt is never accumulating it in the first place. But that doesn’t mean I advise against using credit cards. I don’t. In fact, my wife, Claudia, and I use them almost exclusively for purchases, though without ever paying interest on the debt.

Like a lot of people, we pay off the balance each month. We’ve been able to do this even during points in our marriage when money has been tight. We prefer using credit cards for two major reasons:

Reason 01: If you become a victim of fraud, the fraudster is taking the bank’s money—not yours. With a debit card, the fraudster is taking your money from your bank account. Several credit card issuers have systems to help you detect and resolve fraudulent charges.

Reason 02: With the right credit card, the bank will pay you for using the card. A rewards program will pay out anywhere from 1% to 3%, or more, for using a credit card. If you don’t carry a monthly balance, it means you’re making money by using credit.

However, shifting the bulk of your spending to credit cards makes sense only if you’re able to closely monitor your credit card usage. If you start accumulating a balance on your credit card and can’t pay it off each month, the advantages of using a credit card disappear. When you start amassing credit card debt, you set yourself up for the hard lessons so often featured on Dave Ramsey’s radio program.

Here are three things my wife and I have done over the years that allow us to regularly use credit cards but never carry a credit card balance.

01 Treat your credit card like a debit card

If I could offer only one piece of advice about credit cards, it would be this: Tether your credit card to your checking account. A common theme emerges among many people who fail to pay off their credit card balance each month. It’s not that they don’t make enough income to avoid credit card debt. Yes, some people stumble into debt because of an emergency. But more often than not, people take on debt because they have no sense of whether their income can support their level of credit card spending.

By recording your credit card transactions in your checkbook as if they were debit card transactions, you can easily determine whether you’re generating enough income to justify your credit card spending. Hopefully, you regularly balance your checkbook, even if you write few physical checks anymore. Claudia and I prefer using paper-and-pencil record keeping because it forces us to engage our finances. When relying on computer software to do all the calculations, it’s tempting to become a passive observer.

Entering your credit card transactions in your checkbook will show you in real time whether you need to put the brakes on your credit card before the credit card bill arrives in the mail.

(Tip: Always request a receipt of your credit card purchases. This way, you’ll have a record of your transactions to enter into your checkbook.)

Once you receive your monthly credit card bill, reconcile the transactions listed in the bill with the transactions recorded in your checkbook. This is also a great way to spot any fraudulent charges. If you see an item in your credit card bill that you didn’t record in your checkbook, there’s one of two possibilities: It’s either an unauthorized expense, or you forgot to record it. Every entry in your checkbook should show up in your credit card bill.

(Tip: Use a red-ink pen to record credit card transactions in your checkbook so that they stand out from your cash and check transactions. It’ll be easier to spot the credit card transactions when reconciling them with the monthly credit card bill.)

After you’ve reconciled your transactions, you are ready to pay off the credit card bill. It won’t be a mystery whether you have enough money to pay it because you’ll have already accounted for the expenses in your checkbook.

If you faithfully follow this system, credit card bills should never catch you off-guard. You should be able to pay your monthly credit card bill without ever paying a dime in interest. As a bonus, if you have a cash rewards card, you’ll earn anywhere from 1% to 3% on your purchases. Not a bad deal!

02 Minimize eating out

If you’re vigilantly tracking your credit card expenses and still finding yourself in a cash crunch, it’s time to more closely scrutinize your spending habits. Start with eating out. A silver lining of the coronavirus pandemic is it’s made eating at home more appealing. While it’s unfortunate to see so many small restaurant owners struggling financially, many families are saving money by making more meals at home. Even eliminating one meal a week from your eat-out routine would save a family of four $2,600 each year (with the average meal costing $50).

The reason you’re saving so much money when eating at home is that you’re paying for a lot more than just food at a restaurant. The restaurant business involves a large amount of overhead, meaning your bill is helping to pay the restaurant’s rent, utilities, equipment, insurance, administration and government-mandated licenses. There’s also labor costs, of course. An industry rule of thumb is for food costs to represent only about 28% to 32% of the total food sales. When adding a 20% tip to the bill, the cost of the food itself is even smaller.

Some people aren’t eating out as much because of the coronavirus pandemic, but they’re not saving money because they’re having more restaurant food delivered to their homes. Smartphone apps have made this easier than ever because many of them allow you to submit an order with one press of a button. If you’re getting too many meals delivered to your doorstep, consider making it more difficult to submit an order.

- Remove delivery apps from your phone and use a laptop or desktop for ordering. (Or, get rid of the smartphone altogether.)

- Don’t allow apps to “remember” your credit card number. Enter it manually every time you order food for delivery.

- Stick to a schedule for ordering restaurant food, such as every Friday. Plan to cook the rest of the week.

By eating at home more often, you will make those occasions when you do eat out or order food for delivery feel a little more special.

03 Delay your online purchases

Let items you want to buy online sit in your virtual cart for a few days before clicking the “buy” button. By keeping these items in your cart, you give yourself time to consider whether you truly need an item or whether you just wanted it in the moment. I use this method and am surprised by the number of times I pass on purchases. The delay period cuts down on impulse buys because you gain a different perspective a few days later.

Also, like with removing delivery apps from your smartphone, avoid making online purchases with your smartphone. These devices are built for impulse decisions. Indeed, social media companies design apps to consume as much of users’ time as possible. When buying online, force yourself to pull out your credit card and enter your credit card number each time you make a purchase. Try to make the buying experience less virtual and as “real” as possible.

Online shopping is great because it’s so convenient, but therein lies the danger. Another trick is to ask yourself if you’re willing to travel to a local store to buy the items in your virtual cart. If you truly need an item, you’re more likely to travel across town to buy it.

Why learn the hard way? Don’t get into debt in the first place

Taken together, these three tips won’t guarantee you avoid carrying a balance on your credit card, but they’ll improve your chances. Getting out of debt has become a badge of honor for many people, thanks to Dave Ramsey and others promoting the debt-free life. Debt is dumb, with credit card debt being the dumbest of all. It’s also not frugalmatic because debt saps your financial resources, making it difficult to maximize the value of the things you own and the activities you enjoy.

Why learn the hard way by accumulating credit card debt and then having to get rid of it? Work into your life checks and balances today to guarantee you have the tools for living credit card debt free for years to come. Leave a comment below and let me know what strategies you use for avoiding credit card debt.